Nextdoor - the Anti-Metaverse or the Meta Laggard?

A deep(ish) dive on the neighborhood social network

[Cold] Intro

For all of the metaverse bears selling Facebook stock, it might be worth taking a look at your “friendly” neighborhood social network, Nextdoor. While Facebook has begun shifting its focus toward building virtual worlds, Nextdoor wants to improve the one we’re currently living in.

For the unfamiliar, Nextdoor is the social network for your neighborhood - sign up, enter your address, and you’re immediately connected to your neighborhood timeline full of posts from your neighbors.

I have known of Nextdoor for a few years now - my girlfriend used to scroll it after she exhausted pretty much every other social media newsfeed. However, they didn’t really pique my interest until the current market selloff where they have traded down ~75%, giving them a market cap of ~$1.3bn (~$600mm ex-cash). A lot of this downturn has been macro-related and thus unrelated to anything Nextdoor specifically has or has not done. In a rising interest-rate environment, the opportunity cost of investing in cash-burning tech goes up, and cash flow, rightfully so, becomes the name of the game. People want to be paid sooner rather than later.

While this can be painful in the short term, a selloff of this size can create massive opportunities within companies whose stock price has severely dislocated from the future earning power of the business.

I initially felt Nextdoor was an interesting opportunity for the following:

They have a proven business model and sit in the favorable digital advertising market. “Rising tides lift all ships” or something.

They are still early in their growth phase. Though they’ve had a US product since 2011, they are just now approaching international markets with a ton of runway.

They went public at peak valuation, leaving them with almost $800mm of cash on the balance sheet. Investors who bought the IPO have been ripped apart, but the recent price drawdown probably puts them somewhere closer to fair value.

Behavior shift toward local coming out of the pandemic.

Since I began using the product, researching, and putting my thoughts on paper, my point of view has somewhat shifted.

Let’s dive in.

The Local Graph

Founded in 2008 & launched in 2011, Nextdoor is a social network with the mission of bringing neighborhoods closer together. Neighbors, local businesses, and public agencies all aggregate onto one news feed to interact, share news, get advice, and advertise local businesses/events. What makes Nextdoor unique from other social media companies is its sole focus on local connections. CEO Sarah Friar calls this “owning the local graph”; to paraphrase her, “Facebook owns the friends & family graph, Linkedin owns the professional graph, Nextdoor will own the local graph.”

For the unfamiliar, a social graph is simply a visualization of all the connections between users, businesses, and organizations within a network. The more connections that exist between people, the better the network is for everyone. As more users join, the network strengthens. This is oxygen for social media companies. It’s what keeps users coming back to the app and is crucial to building a great social ad product. To boil down the major advantages of owning a social graph: the company learns A LOT about you. They can tailor your newsfeed almost perfectly to keep you engaged longer, and they can sell ads to clients who want to reach very specific demographics. Once a network is built, it becomes a massive barrier to entry as no sensible business case could justify the costs necessary to displace a network. Even if you could afford it and wanted to take a stab, you still have to convince users to switch over (see: Clubhouse).

Potential of Local

The single focus on Nextdoor owning the local graph makes Nextdoor interesting for a few reasons. First is the favorable trends around all things local - there appears to be a permanent shift borne out of the pandemic towards local connection & commerce. With local businesses bearing the brunt of lockdowns and droves of workers working from home, people care more than ever about the businesses and people within their community. Nextdoor has a chance to take advantage of this shift by being the neighborhood town hall where neighbors can build real connections with each other and local businesses. Management is keenly aware of this opportunity and has shifted its product strategy toward building an “active valued community” to “cultivate a kinder world where everyone has a neighborhood they can rely on.” Recent product developments have supported their statement, with new features such as new neighbor welcoming, user profile enhancements, and connections (friends), all coming onto the platform.

Second, Nextdoor’s neighborhood focus makes it a potentially highly effective customer acquisition tool for local businesses. Often people come onto Nextdoor looking for specific advice or recommendations from their neighbors. CEO Sarah Friar likes to say they come with “very high intent”, meaning they come to Nextdoor with a specific outcome in mind. Therefore, when a user comes to the platform to get advice on the best local salon, dog-watcher, or plumber, local businesses should be able to advertise their services directly to that user. Hyperlocal targeting paired with other learned data points can give Nextdoor a slight edge vs their competition in select industries like real estate, home services (utilities, solar, cleaning), financial services, & “hyperlocal” commerce.

It seems obvious saying out loud, but local advertising should be Nextdoor’s bread & butter - get to scale on the back of delivering an awesome local offering while continuing to invest in and grow the entire conversion funnel for companies of all sizes. Nextdoor can probably increase the size of the pie for local digital advertising over time as they develop better tools and targeting, but ultimately, they will need to be able to compete up and down the conversion funnel for small and large businesses.

Competitive Hurdles

Most of Nextdoor’s issues stem from the fact that its biggest competitors are Facebook and Google - the largest social media company to exist, and arguably one of the best businesses to ever exist in Google. Put simply, all three of these companies make money by aggregating eyeballs and placing relevant & effective ads in front of those eyeballs. Whoever does that best and at the lowest cost to the ad publisher, wins. As a result of their user reach & proprietary technology, Google and Facebook take an overwhelming share of most companies’ digital ad budgets. For new companies like Nextdoor to move out of the “experimental” ad bucket, they have to find ways to differentiate themselves from big tech platforms.

Product Offering

When you look at Nextdoor’s product offerings today, they are incredibly similar to Facebook products, but on a smaller scale. The massive scale Facebook has makes it difficult for any competitor to build an equally compelling social product. They are not zero-sum, people use multiple social apps, but time spent on one is time spent away from the others.

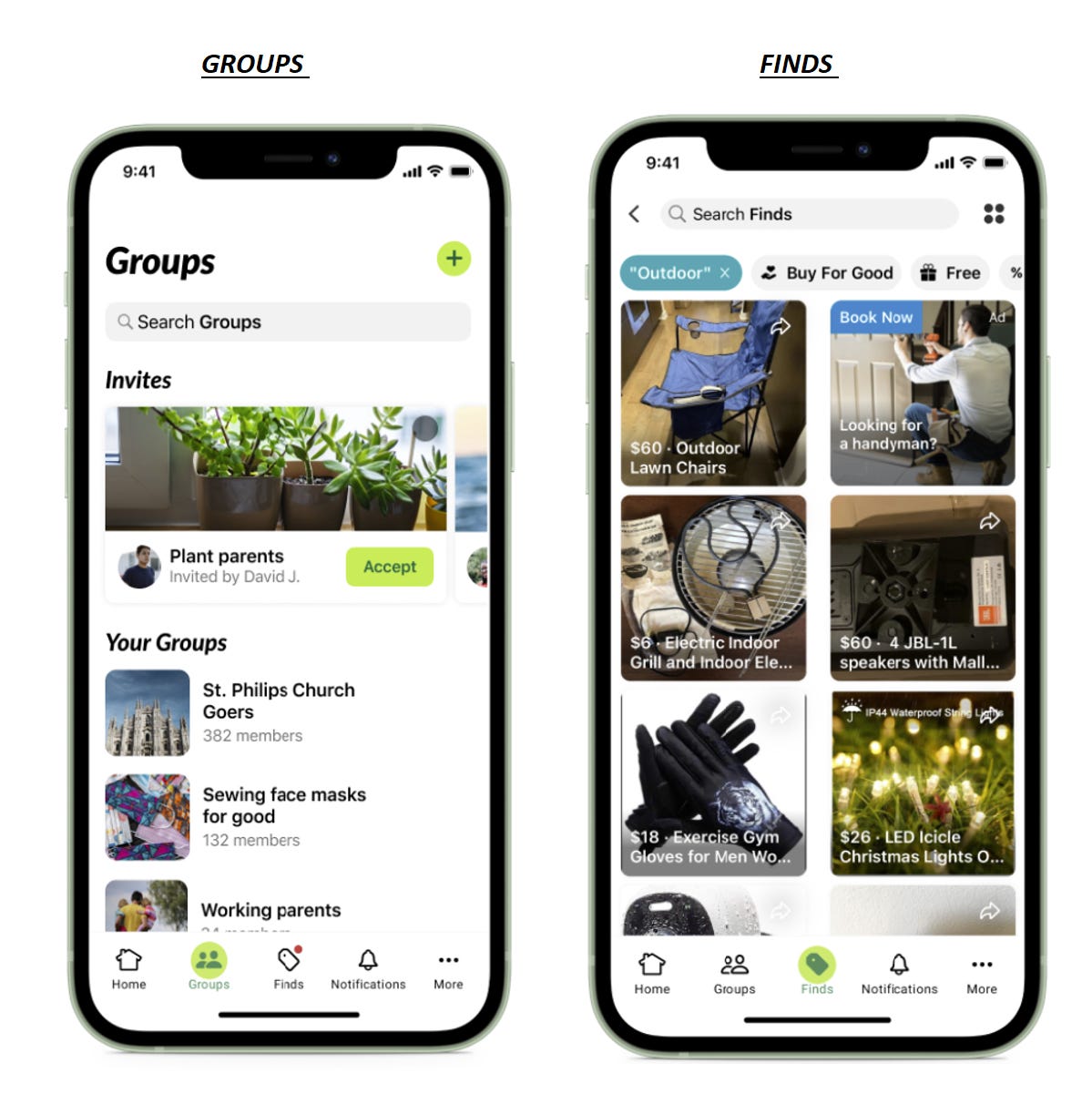

Nextdoor’s main features aside from their social feed (which is essentially a Facebook group for your neighborhood), are “Groups” and “For Sale”. Nextdoor has posited that Groups are better on their platform because they basically guarantee that people can meet up in real life. That sounds great, but the reality is that Facebook groups are already perfect for local communities. Large FB groups are formed in every city with the sole aim of meeting up and doing things in person - sports, business, running, cycling, dog-lovers, you name it. In the context of their “Finds” feature, they are inferior for the same reason. The rate at which stuff sells on Facebook Marketplace is unmatched. Admittedly anecdotal, but every time I’ve listed an item I have offers within the hour, & the item is sold & picked up within 2 days. I don’t even think about using another service.

All of this goes back to owning social graphs and gathering eyeballs - why would I start a group on Nextdoor, when there’s already a large & engaged group on Facebook that meets in person? Why would I sell on Nextdoor Finds, when I can reach more buyers with Facebook marketplace? Nextdoor shines particularly in times of emergency, when crime is committed, or people want to complain about something in the neighborhood. 2 out of 3 of those are important, but it’s not clear to me any of them can drive long-lasting engagement.

Advertising

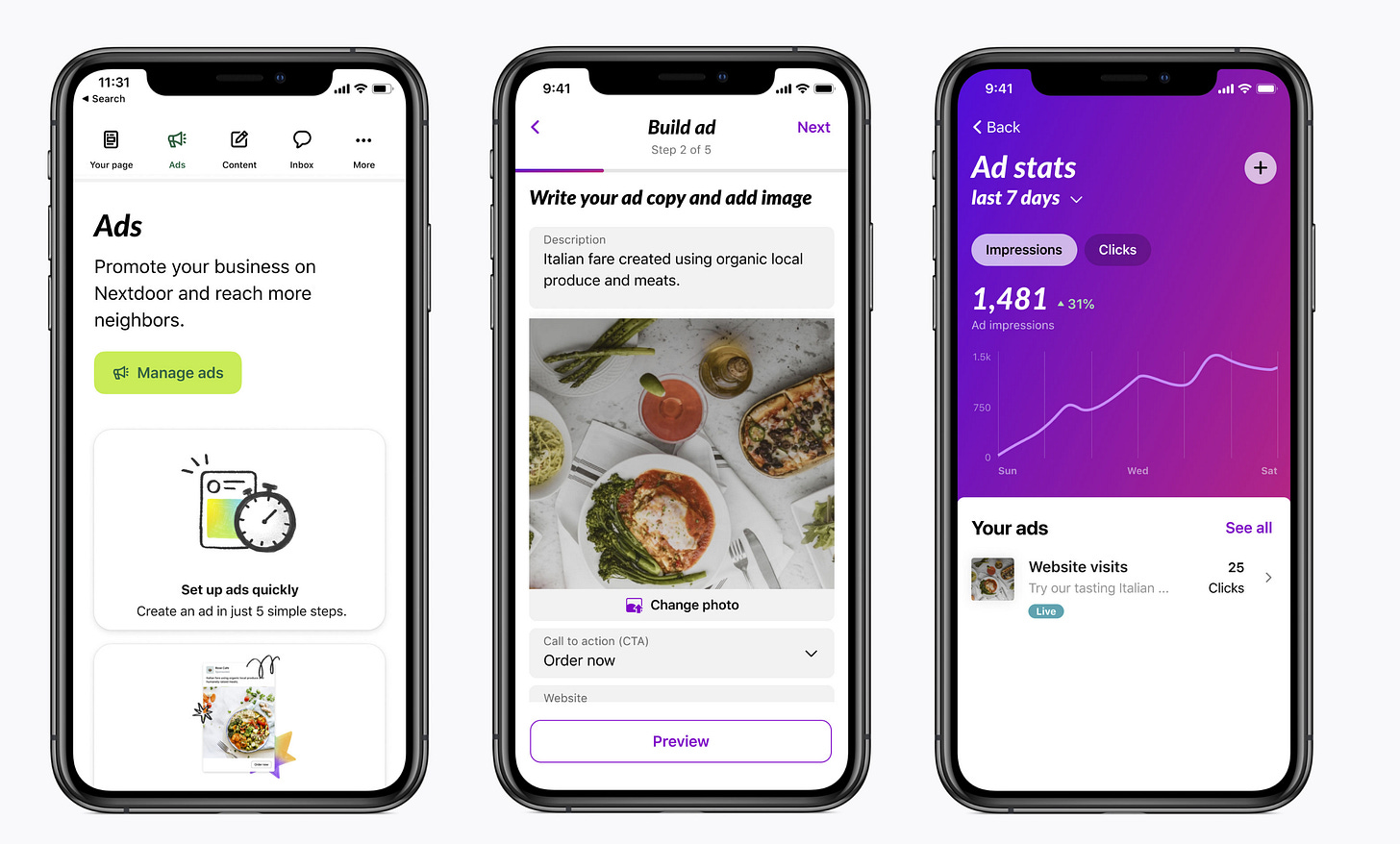

On the client-side, Nextdoor’s current advertising offering is rudimentary at best. This is mostly expected as they are still pre-scale, the question is, can they ever reach scale? The product has already been in the US for 10+ years, the clock is ticking fast.

To be a legit player in the digital ad market, converting customers and driving purchases is ultimately what matters. Brand awareness is good, but the bottom of the funnel (conversions) is where the most value is provided. Nextdoor needs to prove to advertisers that they have enough data points and the right technology to ultimately drive purchase behavior efficiently. This isn’t the case today. Admittedly anecdotal, but almost every time I scroll, I will receive the same ad 5+ times in a row for something completely irrelevant to me. Last week, I received the same ad from J Crew for a girl’s dress almost 10 times in a row. Because Facebook knows so much more about its users and has built out great tech, they’re able to target well, offering advertisers best-in-class rates & performance. Nextdoor users do often come to the app with high intent, but no users have higher intent than Google- we literally tell them what we want! A quick search for “plumber” on Nextdoor reveals their shortcomings relative to Google results - I can’t even tell if the top two unsponsored posts are real businesses.

Investment Analysis

As shown by my earlier Facebook comparisons, I’m not too bullish on the product. I’m also aware that it just might not be for me; the network caters more to an older generation of homeowners and parents, of which I am neither. Maybe there is a real growth engine here, maybe I am a future user. But still, as I write this and continue to think deeper, it just helps sharpen my bull case for Facebook and Google. Why buy a market laggard at a questionable price when you can buy market leaders at historically cheap prices?

With that said, the stock could still be cheap relative to its future earnings power, and I’m curious what kind of growth is expected out of Nextdoor to warrant the current share price. Stock prices reveal expectations of a company’s future performance. Given a company’s stock price, you can roughly back into what type of financial performance the market is expecting about said company.

I’m going to attempt to back into the market’s expectations of Nextdoor by forecasting their key drivers of valuation - users, revenue, and operating margin (EBIT).

[Note: This is a highly input-sensitive analysis, slight changes in any assumptions can show significant differences in valuation. As a result, this by all means should not be considered decision-making analysis, but rather a tool to help think about valuation. We will keep it high level and as conservative as possible, as our goal is simply to back into today’s share price.]

Let’s briefly talk about the assumptions here:

Users: Growing from ~31mm avg WAUs in 2021 to 147mm by 2031 (15% CAGR), with the majority of growth coming from International. 2031 ending numbers are roughly in line with Nextdoor’s second bubble of 203mm verified households in the image below (Global verified neighbors > weekly active users)

ARPU: Assuming an 8% 10-year CAGR in Global ARPU, increasing from ~$5.95 in 2021 to $14.14 in 2031.

Using Pinterest as a reasonable comp, US ARPU feels very conservative & INTL ARPU looks rather aggressive. Nextdoor has been quicker to monetize internationally than Pinterest was so I feel more comfortable there, but I’m still unsure about the US.

Revenue: At a ~15% user CAGR and ~8% ARPU CAGR, Revenue would subsequently grow at a ~24% CAGR for the next 10 years.

69% of 2031 revenue coming from the US

Assuming we widely understated US ARPU and overstated INTL ARPU, they would likely balance out to an even higher absolute revenue number given the roughly equal user mix and more robust US ad market.

EBIT and Share Price:

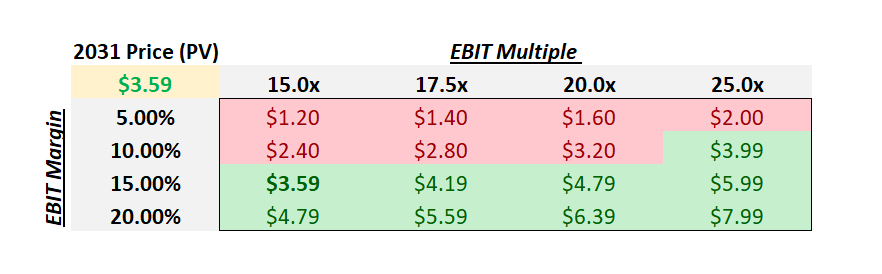

Lastly, we assume a 15% EBIT margin, a 15.0x EBIT multiple (likely conservative), and a 3% annual increase in shares outstanding. The product of these assumptions gets us to our 2031 market cap of ~$4.7 billion, and a share price of $9.32. Discounting the 2031 share price back to today at a 10% hurdle rate, we arrive at a share price of ~$3.59 (vs todays ~$3.33).

To visualize how sensitive this analysis is to the assumptions, the table below shows changes in the discounted 2031 share price based on changes in the EBIT margin and multiple.

Conclusion

Given my current view of the product relative to the competition, the implied growth needed, and a brutal market environment, I am not a buyer here. My reasoning has less to do with Nextdoor’s ability to hit growth expectations and more to do with opportunity cost. I simply believe there are significantly better risk/reward prospects available today - namely in $KIND’s competitors mentioned above.

I am still learning as I go and will continue to monitor the company, looking for any positive inflections in user growth, engagement, monetization, and product changes.

If you felt like you learned something or the writing benefitted you in any way, then this was a win for me. I’m eager to get better and thus always open to feedback - love it or hate it, let me know.

Reach out on Twitter @_agarner, DMs are always open.